China Is Leading the Clean Energy Revolution

China is leading a global shift toward renewable energy. For the third time in a row, China has ranked in the 1st place in EY’s Renewable Energy Country Attractiveness Index (RECAI).

Moving Forward with Renewable Energy

In 2016, China released its 13th Five-Year Plan. It emphasizes developing an “ecological civilization” in which renewable energy development plays a major role. In pursuing this plan, China intends to increase the share of non-fossil fuel sources as a fraction of its total electricity production to 39 percent by 2020. By 2030, non-fossil fuel sources will account for 20 percent of China’s electricity consumption. This plan does not include electrification.

Solar energy is developing rapidly in China. By 2017, solar-power capacity had reached approximately 130 GW, which is more than that of any country in the world. Also, China has achieved its 2020 target for solar energy three years early.

This development is not only driven by the national targets, but also by economic considerations. As one of the major solar-panel manufacturers worldwide, China has an economic interest in developing solar energy as the cost of solar photovoltaics decline.

While solar energy is growing significantly in China, what about wind energy? China has already reached 169 GW of wind capacity in 2017. This means that it is on track to fulfill or potentially surpass its target of 210 GW of wind energy by 2020.

Renewable energy development also varies by region in China. Northwestern provinces have relatively greater potential for solar and wind, while hydropower is more concentrated in the southern region.

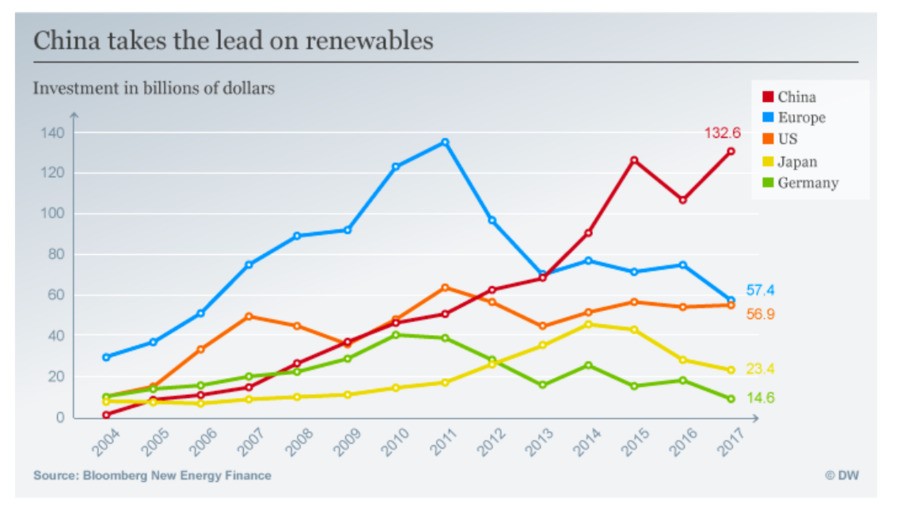

The spread of renewable energy is closely connected to the increase in investment. A graph from Bloomberg New Energy Finance shows China invested approximately $133 billion USD in renewables in 2017. This is more than twice as much as the investment that took place in the United States. China, shown by the red line, surpassed the United States in its investment in renewables by 2012.

However, China is facing some challenges in expanding clean energy.

“The challenges brought by rapid development of renewables are rooted in China’s electric power system,” said Shuo Li, senior climate and energy policy officer from Greenpeace East Asia.

Li said China’s electric power system is different from that of western countries. It lacks some basic market-based elements. This somewhat discourages the advance of renewables.

According to Li, China needs a price-support mechanism such as a feed-in-tariff (FIT) in the early development stage of renewable energy. Setting the right price level of a renewable FIT is quite tricky. A high FIT causes inefficiency and discourages innovation, while a low FIT is not effective in promoting renewables.

“China has encountered some setbacks along the way,” Li said. “But overall China has adjusted its policy quite smoothly and successfully for the development of the clean energy.”

Creating a National Carbon Market

In the big picture, one of the key drivers behind the Chinese government’s ambitious goal to develop clean energy is air pollution. The shift from coal to renewable energy is part of China’s environmental strategy that includes carbon markets, energy efficiency, and green financing.

In 2017, China officially launched its national carbon market. As the largest emitter of greenhouse gases, China demonstrates its commitment to address air pollution and climate change through putting a price on carbon.

In fact, China has started seven regional pilot carbon markets in 2013 and 2014.

“Originally, the goal was to encourage emission reduction and minimize the cost through a carbon market,” said Lele Zou, researcher and associate professor at Chinese Academy of Sciences.

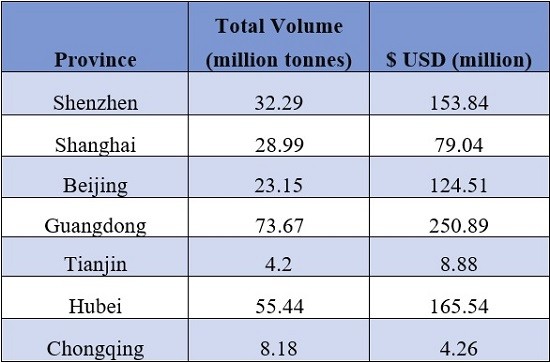

The table below shows the total carbon-trading volume and its equivalent in United States dollars. Until May 2018, the total trading volume was around 226 million tonnes of carbon, which equals $787 million USD. This means that China’s seven pilot programs have grown over time in terms of total trading volume. Provinces vary in their performance.

The pilot programs contribute to the market design of a national carbon market, yet many challenges remain. According to Zou, each pilot program has different standards and trading platforms. This has created some obstacles to establishing a unified carbon market.

Also, many companies were reluctant to participate in the regional pilot programs. This is due to the uncertainty around the future of the carbon market after the pilots.

“The current trend is to improve the design of the national carbon market and extend it beyond the power industry,” Zou said. “We need to ensure that the national carbon market is long-term and stable, sending a strong signal and injecting confidence into the market.”

“In order to further incentivize clean energy innovation and development, the establishment of a forward market is essential,” Zou said. A forward market is an over-the-counter marketplace that sets the price of a financial instrument or asset for future delivery.

“Right now, China’s carbon market is purely a spot market and the possibility to make any profit is very small,” Zou said. “Also, because the emission-reduction costs are vague, the price-discovery function does not really exist in the market. Adding a forward market will make carbon trading more attractive, stable and predictable.”

In 2020, the actual trading is expected to begin in China’s national carbon market. This year will be a crucial time for China to improve the market design of the national market, build capacity for transactions, and ensure the effectiveness of this market.

To comment on this article, please post in our LinkedIn group, contact us on Twitter, or use our contact form.